If you’re a first-time buyer in England, you can now apply for a Help to Buy: Equity Loan. The new Help to Buy: Equity Loan scheme (2021-2023) is now accepting applications with buyers able to move into properties from 1 April 2021, find out more about this and decide if it could be for you!

The Help to Buy: Equity Loan scheme (2021-2023) aims to make it easier for First Time buyers to achieve a smaller deposit and get on the ladder quicker. With this particular scheme the first time buyer will only be able to put these funds towards the cost of buying a newly built home.

Please note: 5% is the minimum deposit, it is not capped. If you have a larger deposit you will be able to put this down also.

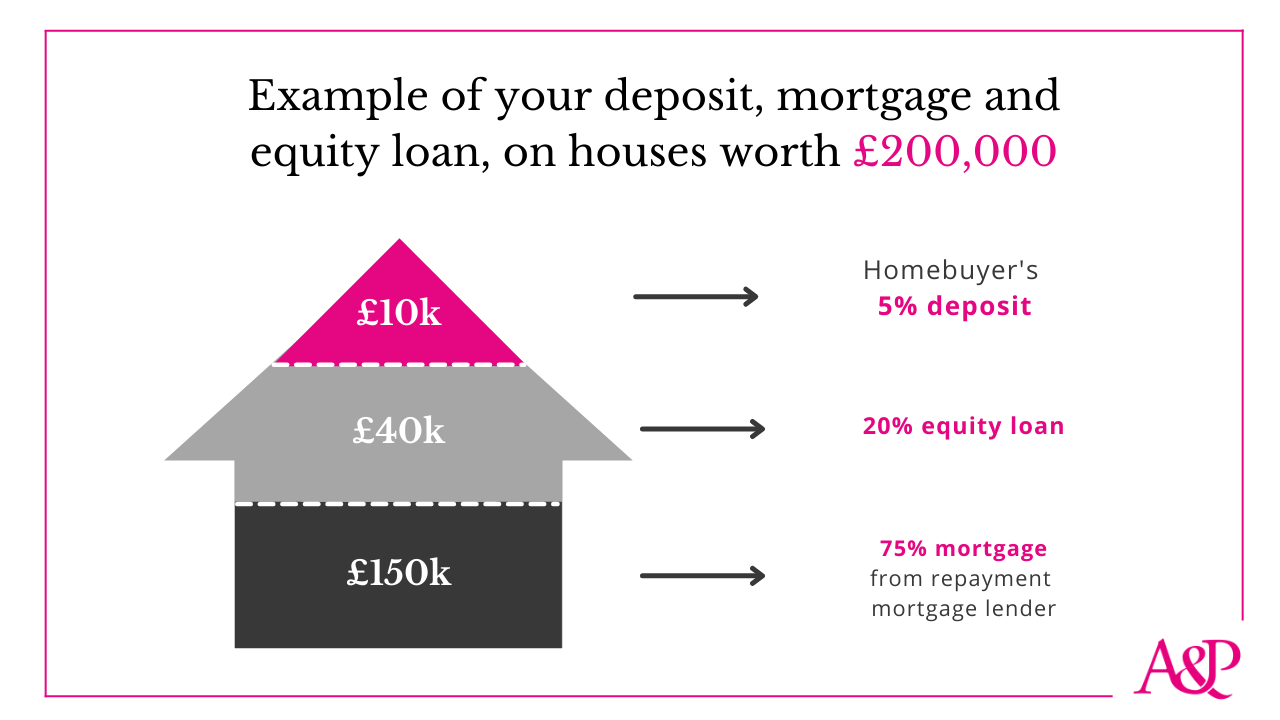

You can borrow (loan) a minimum of 5% and up to a maximum of 20%, although this differs due to location, e.g. you could borrow up to 40% in London. This percentage will be based off of the full purchase price of a new-build home.

(Breakdown of deposit, equity loan and mortgage structure)

Is this scheme for you? Am I eligible?

- Borrowers must be a first-time buyer

- The new build home must be within the relevant regional price cap.

- Not own a home or residential land now or in the past in the UK or abroad

- Not have had any form of sharia mortgage finance.

If you have this scheme in mind, we suggest that you check that the homes you intend to view are from a homebuilder registered for Help to Buy: Equity Loan.

As with previous schemes, the government will lend first-time buyers in England up to 20 per cent of the cost of a new-build home or 40 per cent in London, with borrowers required to pay a further five per cent deposit. The remainder is then made up of a mortgage. The loan is interest-free for five years.

The new scheme has brought in a minor change, Help to Buy will now have regional price limits set at 1.5 times the average first-time buyer price in each region of England.

In the first 5 years:

- The equity loan is interest free

- You pay a £1 monthly management fee by Direct Debit

After 5 years:

- Pay the £1 monthly management fee

- Pay monthly interest fee of 1.75% of the equity loan

- Interest rate will rise each year in April by the Consumer Price Index (CPI), + 2%

- Continue to pay interest until you repay your loan in full

Please note: When you take out your equity loan, you agree to repay it in full, plus interest and management fees by the end of the loan term, or when you sell your home.

With this scheme, the amount you pay back is worked out as a percentage of the market value at the time you choose to repay.*

So why choose an Equity Loan?

Using an equity loan rather than the traditional 10-15% deposit has some major key benefits.

Firstly, you can get on the property ladder quicker as you will only need a 5% deposit. It will also mean that you have better access to mortgages, as you’re only borrowing (mortgaged) 75%, instead of up to 95%.

Plus as Help to Buy equity loans are a percentage of the property value, rather than a set cash amount, you could end up paying back either more or less than you borrowed, depending on whether your home rises or falls in value.

Confused about other loan types, and how to get on the ladder as a first time buyer? Don't worry, simply call your local Arnold & Phillips and we can help find a mortgage advisor that will be there to answer all your questions. Get in touch today

Government outline for Help to buy: equity loan scheme (2021-2023)